About Tranche 2

Australia’s anti-money laundering laws are expanding. If you work in real estate, conveyancing, accounting, legal or virtual asset services, you may be subject to new AML/CTF compliance obligations known as Tranche 2.

What is Tranche 2 and AML/CTF?

Tranche 2 refers to the expansion of Australia’s Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) act to include additional professions and industries. It brings more professions under AUSTRAC regulation to detect and prevent financial crime.

It requires businesses and professionals to verify customer identities, monitor transactions and report suspicious activity to AUSTRAC.

Who needs to comply with Tranche 2?

- Real estate agents (including buyer’s agents and property developers)

- Conveyancers

- Accountants and tax agents

- Lawyers

- Virtual asset-related services

- Other service providers offering designated services

If you handle client funds, large transactions or high-risk financial activity, these rules will likely apply to you. If you're unsure if these rules apply to you, use AUSTRAC’s online check to learn more.

When does Tranche 2 come into effect?

The legislation has passed, and the rules around Tranche 2 AML compliance are being finalised.

- Full compliance will be required from July 1st 2026.

- Enrolment opens March 31st 2026.

JUN

1

Public consultation on draft rules

JUL

AUG

2

Final AML/CTF Rules Published

SEP

3

Learn About the Changes in Detail

OCT

NOV

DEC

4

Sector-Specific Guidance Finalised

JAN

5

Choose AML Provider or Develop Internal Processes

FEB

MAR

6

Formal Austrac

Enrolment Opens

APR

Finish System Setup

Trial Run

MAY

JUN

7

Relax if You're with easyAML

JUL

8

Obligations Commence

What is required under Tranche 2?

-

Enrol with AUSTRAC

Register your business with AUSTRAC by July 2026.

- Complete AUSTRAC enrolment form

- Provide business structure details

- List designated services offered

- Identify key personnel

- Submit contact information

- Appoint a compliance officer

- Establish reporting channels

- Set up AUSTRAC Online access

How does easyAML help?

- Step by step guidance

- Local support whenever you need it

-

Implement an AML/CTF Program

Develop and maintain a written, risk-based compliance program tailored to your business.

- Develop written AML/CTF policies

- Create CDD procedures

- Design transaction monitoring

- Build reporting processes

- Establish record-keeping systems

- Create governance structure

- Document all procedures

- Formally approve Program

How does easyAML help?

- Industry-specific AML/CTF program builder

- Guided, AUSTRAC-aligned risk assessment setup

- Complete program - policies, procedures, and controls

- Your program is kept up to date and compliant

-

Verify your customers

Conduct checks to verify the identity of buyers and sellers that you deal with on property transactions.

- Conduct ML/TF/PF risk assessment

- Identify customer risk factors

- Assess product/service risks

- Consider geographic risks

- Document risk methodology

- Evaluate delivery channel risks

How does easyAML help?

- Easy biometric identity verification (Powered by Scantek)

- PEPs, sanctions & criminal watchlists screening

- ABN/ACN lookup and beneficial owner checks

- Complete KYC, KYB and KYE checks

-

Ongoing due dilligence

Regularly monitor client activity and reassess their risk. Records need to be maintained for at least seven years.

- Undertake Customer Due Diligence

- Monitor customer transactions

- Review customer risk ratings

- Track regulatory changes

- Conduct internal audits

- Test compliance controls

- Measure program effectiveness

- Report to management

How does easyAML help?

- Continuous transaction monitoring

- Customer behaviour analysis

- Automated risk assessments

-

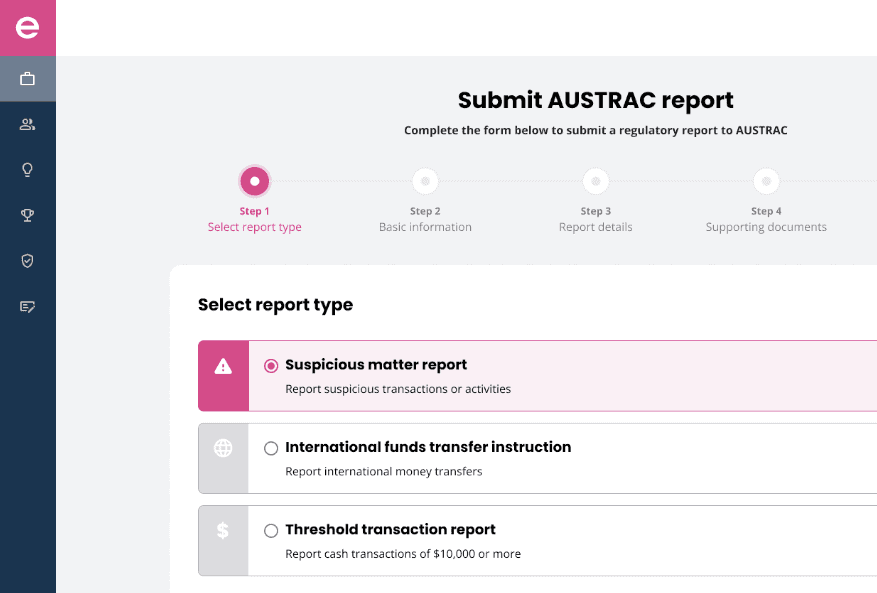

Reporting suspicious matters

Report activity that seems unusual or suspicious to AUSTRAC.

- Submit SMRs within 72 hours

- File TTRs for $10,000+ cash

- Report IFTIs

- Maintain 7-year records

- Respond to AUSTRAC requests

- Annual compliance reports

- Board/management updates

- Document all decisions

How does easyAML help?

- Suspicious activity alerts

- One click AUSTRAC-ready reports

- Secure 7 year record storage compliance

-

Staff Training

Make sure your team understands red flags and reporting steps.

- Develop role-specific training modules

- Conduct initial training for all staff

- Implement new employee onboarding

- Schedule annual refresher training

- Create sector-specific risk training

- Test understanding with assessments

- Establish clear reporting lines

- Define roles and responsibilities

How does easyAML help?

- On-demand compliance training modules

- Quizzes, walkthroughs and downloadable resources

- Local Australian-based support whenever you need it

What are the consequences of non-compliance?

-

Legal consequences

Depending on the nature and severity of the compliance breach, businesses may face a combination of the following legal actions:

- Enforceable undertakings. These are court-enforceable commitments to fix compliance failures.

- Infringement notices. Fines for specific breaches of AML/CTF rules.

- Remedial directions. Instructions to take specific action to prevent the same breach from occurring again.

- Civil penalty orders. Financial penalties imposed by the courts for serious breaches.

- Written notices. AUSTRAC may direct you to appoint an external auditor or conduct a risk assessment.

- Suspension or cancellation of registration.

- Referral for criminal investigation, where appropriate.

-

Penalties

Failing to comply with AML/CTF laws can result in significant fines. AUSTRAC penalties are calculated using penalty units. Currently, one penalty unit is valued at $313.

- Individuals who breach their AML/CTF obligations can be charged up to 20,000 penalty units. This means an individual can be charged up to $6,260,000.

- Body Corporates that breach their AML/CTF obligations can be charged up to 100,000 penalty units. This means a body corporate can be charged up to $31,300,000.

It’s important to realise that these aren’t just "big bank" numbers.

These penalties can be applied by AUSTRAC to any business that fails in its anti-money laundering obligations.

How much will Tranche 2 compliance cost?

Without easyAML:

According to the RIS by the Attorney General’s Department, the average ongoing cost per business is $23,250 per year. Costs will vary from business to business and may include:

- Administration time and lost productivity.

- Software fees, including KYC/KYB tools.

- Professional consultation and services fees.

- Staff training and appointment of AML/CTF compliance officer.

- Policy and AML/CTF program drafting by legal experts.

With easyAML:

- All-in-one platform for complete Tranche 2 compliance.

- Step-by-step guidance with no compliance experience required.

- Local Australian support team for all of your Tranche 2 queries.

- Program implementation in as little as 20 hours.

- Seemless workflows built specifically for Tranche, to minimise administration burden and maximise ease of compliance.

Pricing starts at $179/month +gst for a team of 5.

Tranche 2 compliance is easy with easyAML

Our AML/CTF platform is purpose-built for Australian businesses facing Tranche 2, supported by our local Aussie team.

- Step by step guidance

- Fully AUSTRAC-aligned solution

- No compliance experience required

Join a webinar and get the answers you need

Register for one of our upcoming sessions to see how easyAML turns complex Tranche 2 requirements into simple steps, with real examples and a chance to ask your questions.

Tranche 2 AML/CTF FAQs

-

Do I need to start Tranche 2 AML compliance now?

Not technically. As of 2025, the rules are still being developed. Nothing is enforceable yet. However, Tranche 2 is confirmed and on its way. Starting now allows you to plan, budget and test your systems, rather than scrambling to meet deadlines under pressure closer to 2026.

-

Will these changes definitely happen?

Yes, the Australian Government has committed to Tranche 2 as part of its promise to meet global anti-money laundering standards. Delays are possible during finalisation, but full implementation is no longer in question. It's not optional, it's on its way.

-

What happens if I don’t comply with Tranche 2?

If your business ignores Tranche 2 obligations once they’re live, you could face regulatory action from AUSTRAC. Failing to comply could risk fines, investigations or client trust. The good news? Preparing as early as you can gives you control and peace of mind.

-

How much will AML/CTF compliance cost?

We know cost matters, especially for small businesses. That’s why easyAML is built to be affordable and scalable. Here’s how Tranche 2 costs might look based on the Attorney General’s Department’s Impact Analysis estimates:

Business Turnover Upfront Cost Annual Cost Under $200,000 ~$4,040 ~$6,020 Over $200,000 ~$28,650 ~$33,230 -

Where can I learn more about Tranche 2 AML/CTF?

Head to AUSTRAC’s official website for updates, or contact the easyAML team to discuss your specific situation and next steps. We're here to help you navigate what's coming with clarity and confidence. Our support team handles the ongoing monitoring and updates, keeping compliance simple for your business.

-

What’s the difference between Tranche 1 and Tranche 2?

Tranche 1 covered banks, casinos and money transfer services. Tranche 2 extends AML/CTF obligations to real estate agents, lawyers, accountants and other professional services. While Tranche 1 businesses have been complying for years, Tranche 2 brings these requirements to small and medium businesses for the first time.

-

Can my small business be exempt from Tranche 2?

Most businesses in covered sectors will need to comply, regardless of size. While final exemptions aren't confirmed, AUSTRAC typically doesn't provide blanket small business exemptions for AML/CTF obligations. It's best to assume you'll need to comply and prepare accordingly rather than risk penalties later.

-

How will AUSTRAC check if I'm compliant?

AUSTRAC checks compliance through things like document reviews, site visits and monitoring your reporting. If your policies, procedures, training records and systems are solid and your records are up to date, you’ll be in good shape. Proper documentation is essential in demonstrate your compliance efforts during any AUSTRAC review or audit.