Your all-in-one Tranche 2 compliance solution

Our AML/CTF platform is purpose-built for everyday businesses facing Tranche 2, supported by our local Aussie team.

- Step by step guidance

- Fully AUSTRAC-aligned solution

- No compliance experience required

Purpose built for Australian SMEs facing Tranche 2

Real estate agents

Real estate agents, buyer’s agents, property developers

Learn more about easyAML and Tranche 2 for Property Professionals

Conveyancers

Conveyancers, settlement agents, property lawyers

Legal practitioners

Lawyers, solicitors, legal practitioners

Learn more about easyAML and Tranche 2 for Legal Professionals

Accountants

Accountants, tax agents, business advisors

Learn about

Tranche 2

Understand your AML/CTF

obligations and Tranche 2

Explore our

platform

AML software built for

Tranche 2 professionals

See our

pricing

Simple, transparent pricing

for Australian businesses.

FAQs

-

What should I look for in an AML solution for a small business?

Smart AML solutions simplify workflows while meeting every compliance requirement. Look for a platform that includes digital ID verification, risk assessment tools, automated monitoring and audit-ready reporting. For small businesses, simplicity and local support are key, especially with Tranche 2 expanding AUSTRAC obligations to new sectors.

-

What sets Australian AML solutions apart from global providers?

Australian AML software must align with AUSTRAC’s unique regulatory framework. While global tools may be built for FATF or US-based standards, local software (like easyAML!) is purpose-built for Australian laws, including Tranche 2. That means accurate compliance, fewer workarounds and workflows tailored to local risk and reporting obligations.

-

What’s the difference between AML solutions and compliance software?

AML solutions often refer to a complete suite, covering ID checks, training, policies, reporting and monitoring. AML compliance software usually focuses more narrowly on documentation or reporting. easyAML does both: it's a complete AML solution with built-in software tools tailored to meet all of your Tranche 2 needs.

-

Is easyAML an AUSTRAC-approved compliance solution?

While AUSTRAC doesn’t “approve” providers, easyAML is fully aligned with its guidance and obligations. We build our platform based on AUSTRAC’s compliance requirements and update it as new rules emerge, so you’re never left guessing what’s needed to stay compliant.

-

How does AML software support audit readiness?

Audit-readiness is baked into the best AML software. easyAML stores all verification records, policy changes and monitoring logs securely, in AUSTRAC-compliant formats. If audited, you’ll be able to generate required reports instantly, with proof of compliance steps already documented and time-stamped.

-

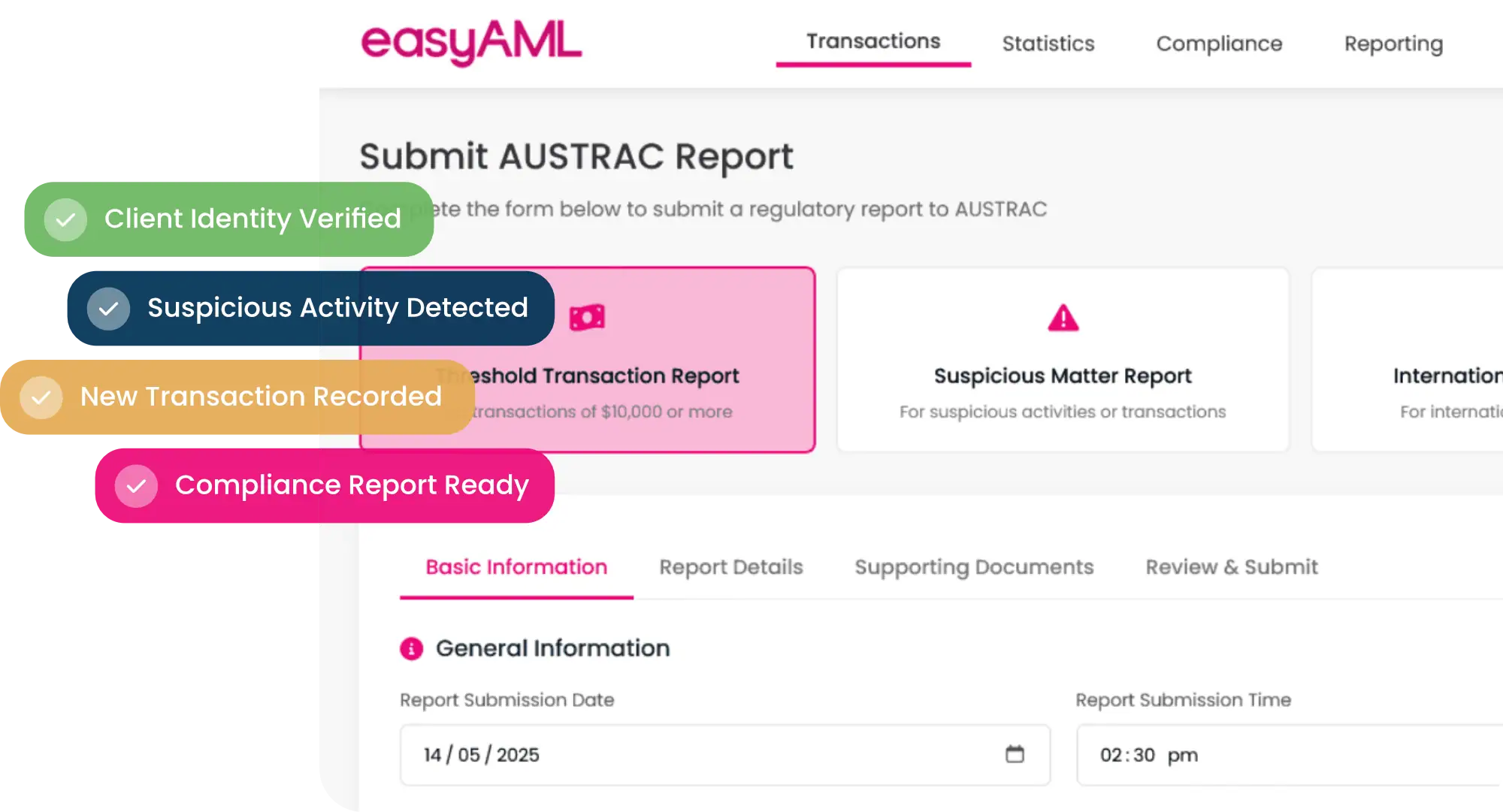

Is AML software equipped for all AUSTRAC obligations like SMRs and TTRs?

Yes. Modern AML software is designed to support all key AUSTRAC reporting obligations, including Suspicious Matter Reports (SMRs) and Threshold Transaction Reports (TTRs). The software helps detect suspicious activity and transactions that meet reporting thresholds, automates report generation and ensures timely submission through AUSTRAC’s secure portal.

-

How do AML compliance solutions support audit readiness and record-keeping?

AML compliance solutions centralise and securely store all required records, including customer identification (KYC), transaction data, AML program documentation and reports submitted to AUSTRAC. These systems maintain detailed audit trails and provide easy retrieval of records for the mandatory seven-year retention period. This way, you’re always prepared for AUSTRAC audits or investigations, demonstrating transparent and verifiable compliance with AML/CTF laws.

-

How do AML solutions support transaction monitoring and red flag detection?

AML software continuously monitors transactions using predefined risk rules and behavior patterns to detect potential money laundering or terrorism financing. It uses rule-based algorithms to detect structured transactions and high-risk activity. When suspicious activity is detected, the system generates alerts, enabling compliance officers to investigate and decide whether to file Suspicious Matter Reports (SMRs) with AUSTRAC.

-

How does AML software integrate with my existing client onboarding process?

AML software integrates seamlessly with client onboarding workflows by embedding customer identification (KYC) and due diligence checks directly into the onboarding process. This ensures that all customers are verified before receiving designated services, using document verification, electronic identity verification and risk assessments.

-

What are the benefits of using a local Australian AML solution over international platforms?

Using a local Australian AML solution offers several advantages:

Reduced risks associated with cross-border data privacy and compliance issues.

Tailored to AUSTRAC’s specific regulatory requirements, reporting formats and deadlines.

Up-to-date with local AML/CTF law changes, including Tranche 2 expansions and sector-specific rules.

Customer support teams familiar with the Australian regulatory context and business environments.

Integration with AUSTRAC Online for smooth, compliant reporting.

Faster response times and training resources aligned with local compliance expectations.

Less compliance,

more life.

We're here to help you understand what's coming, guide you through it and provide an all-in-on solution.