easyAML is your all-in-one Tranche 2 platform

The only platform with everything you need for complete Tranche 2 compliance. From step-by-step guidance to industry leading verification and monitoring tools.

No compliance experience required.

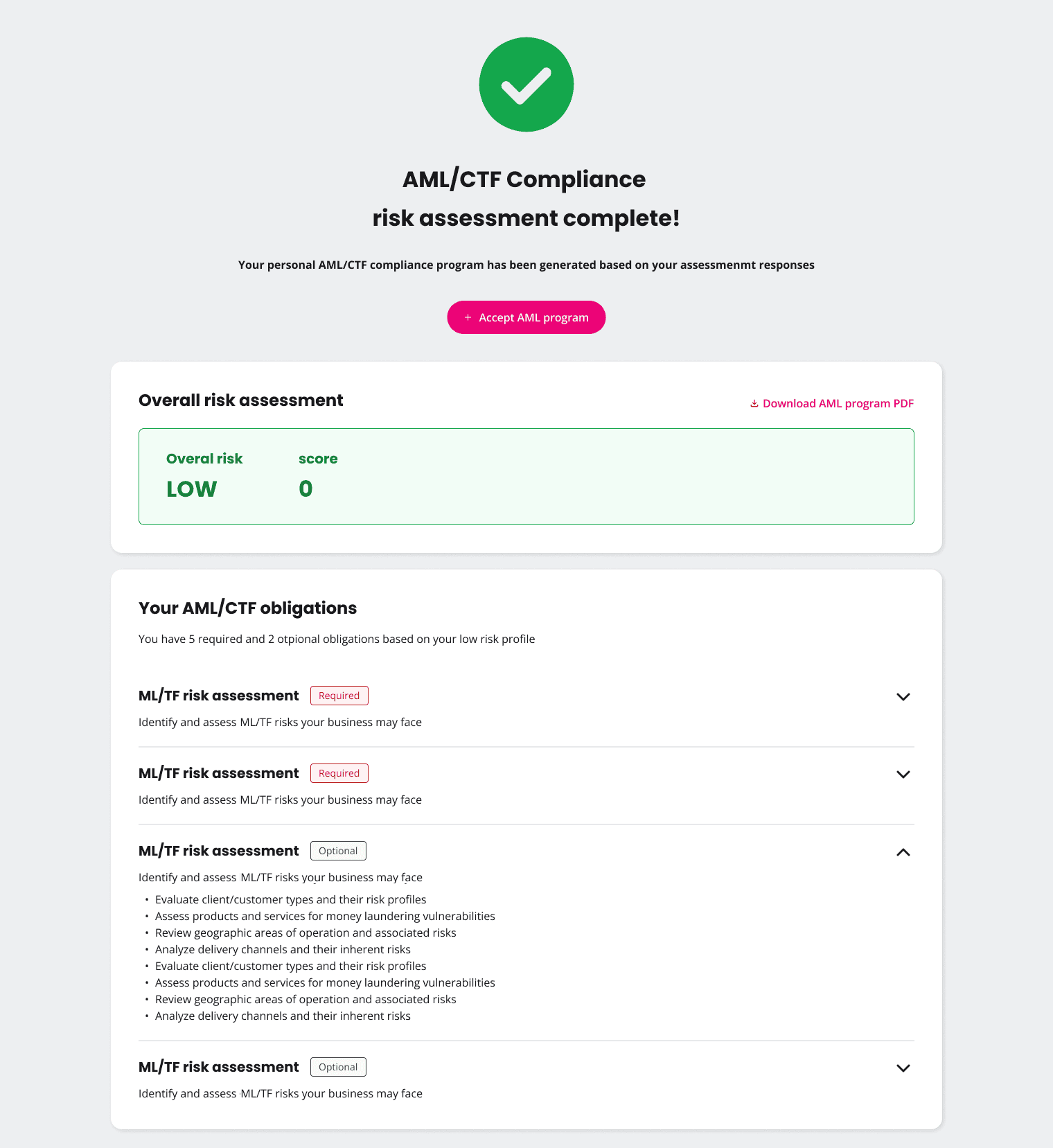

1. Done-for-you AUSTRAC-compliant AML/CTF Program

Our guided program builder will help you create and implement an AML/CTF program that is specific to your business. With simple workflows, clear roles for your team, smart risk assessments, and audit-ready documentation.

- Industry-specific AML/CTF program builder

- Guided, AUSTRAC-aligned risk assessment setup

- Complete program - policies, procedures, and controls

- Your program is kept up to date and compliant

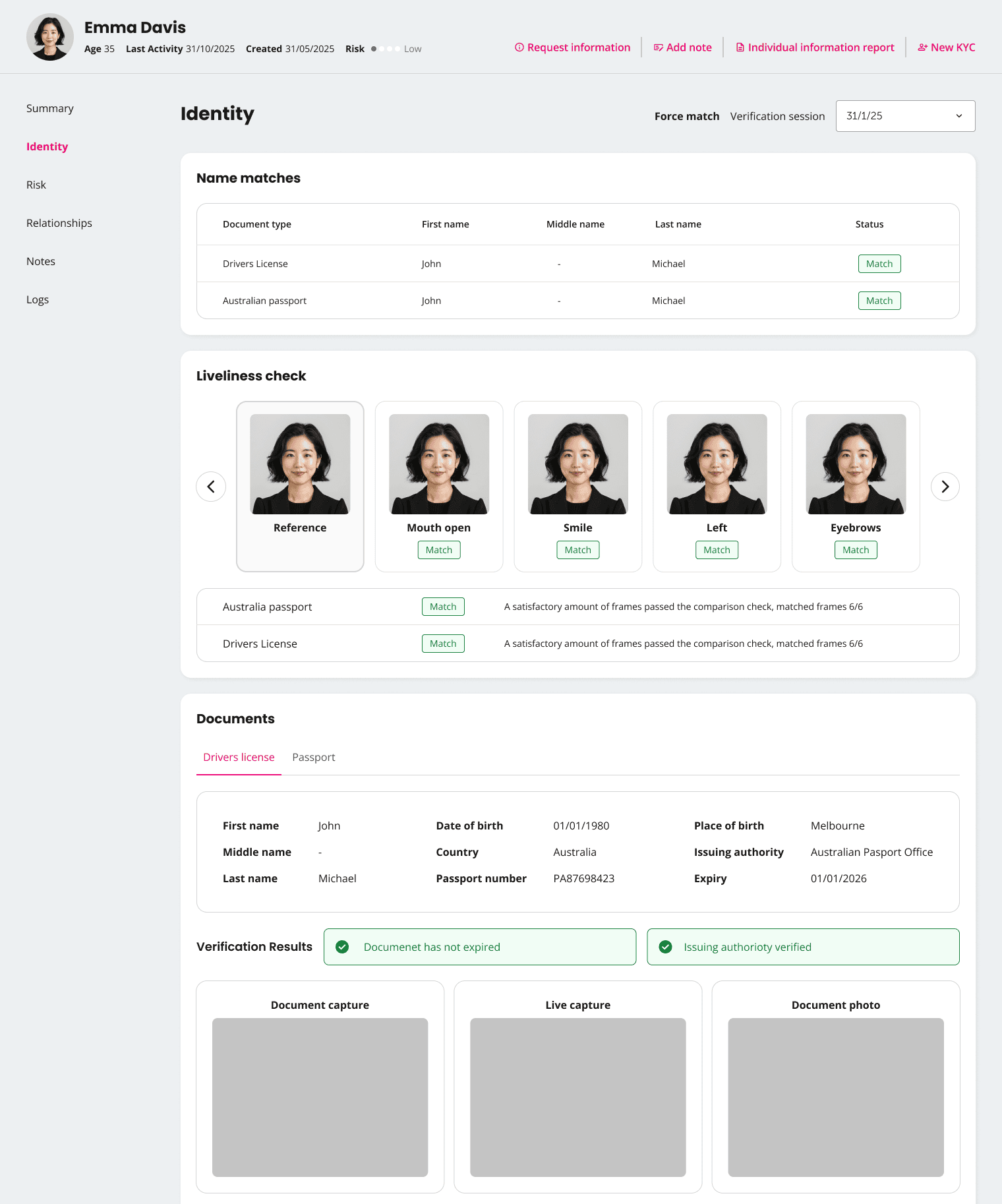

2. Complete identity verification, KYC and KYB Tools

Send your client a link to a simple 60 second ID verification process (powered by Scantek’s ISO 27001 compliant platform), and easyAML handles the rest:

Liveness validation, biometric verification, location data, and back-to-source document checks to verify the identity of your client. Followed by PEPs screening, sanctions checks, and adverse media screenings, to build a complete KYC profile.

- Easy biometric identity verification (Powered by Scantek)

- PEPs, sanctions & criminal watchlists screening

- ABN/ACN lookup and beneficial owner checks

- Complete KYC, KYB and KYE checks

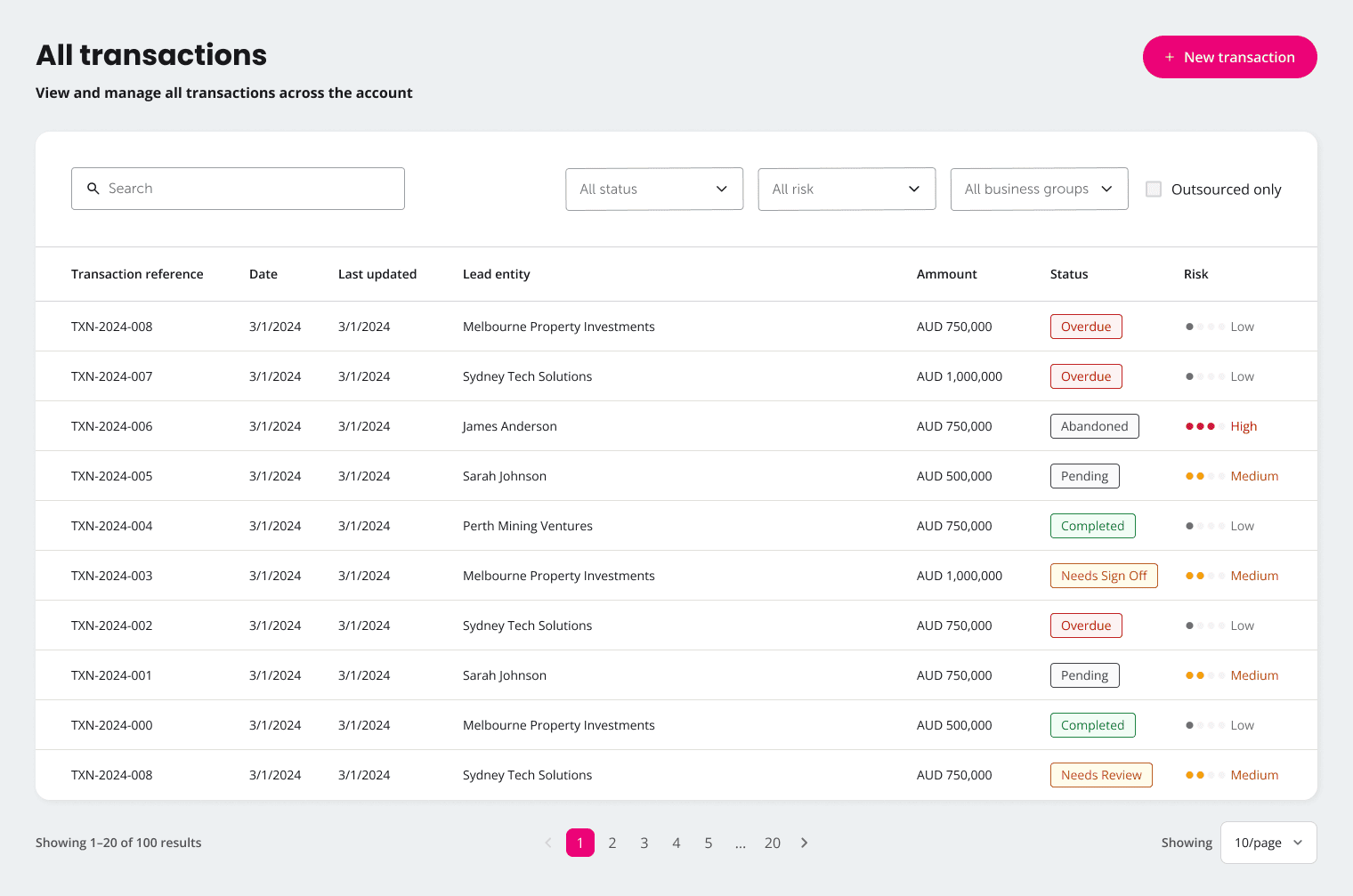

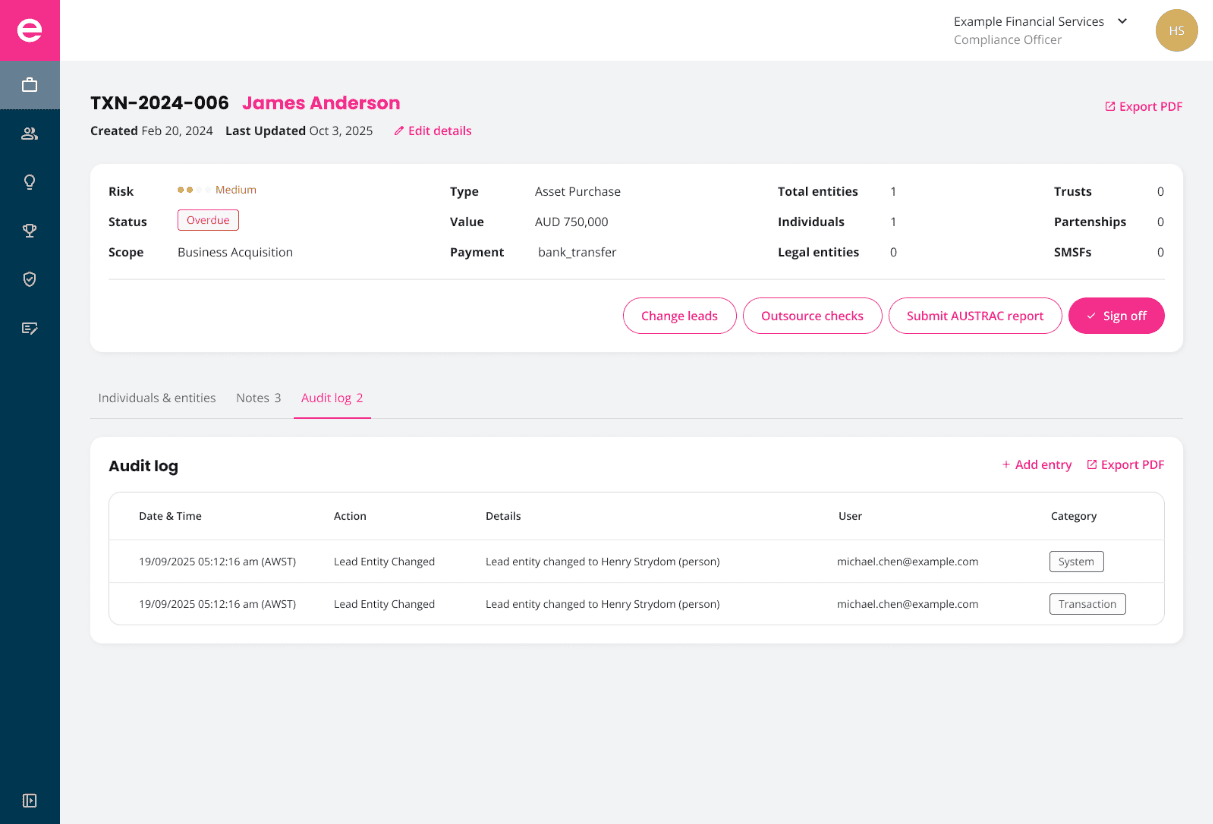

3. Fully automated, continuous monitoring

Automated transaction monitoring, behavioural analysis, and suspicious activity alerts. When changes are detected, your risk assessments are re-evaluated, you're prompted to report suspicious matters to AUSTRAC, and your AML/CTF program is kept up to date.

- Continuous transaction monitoring

- Customer behaviour analysis

- Automated risk assessments

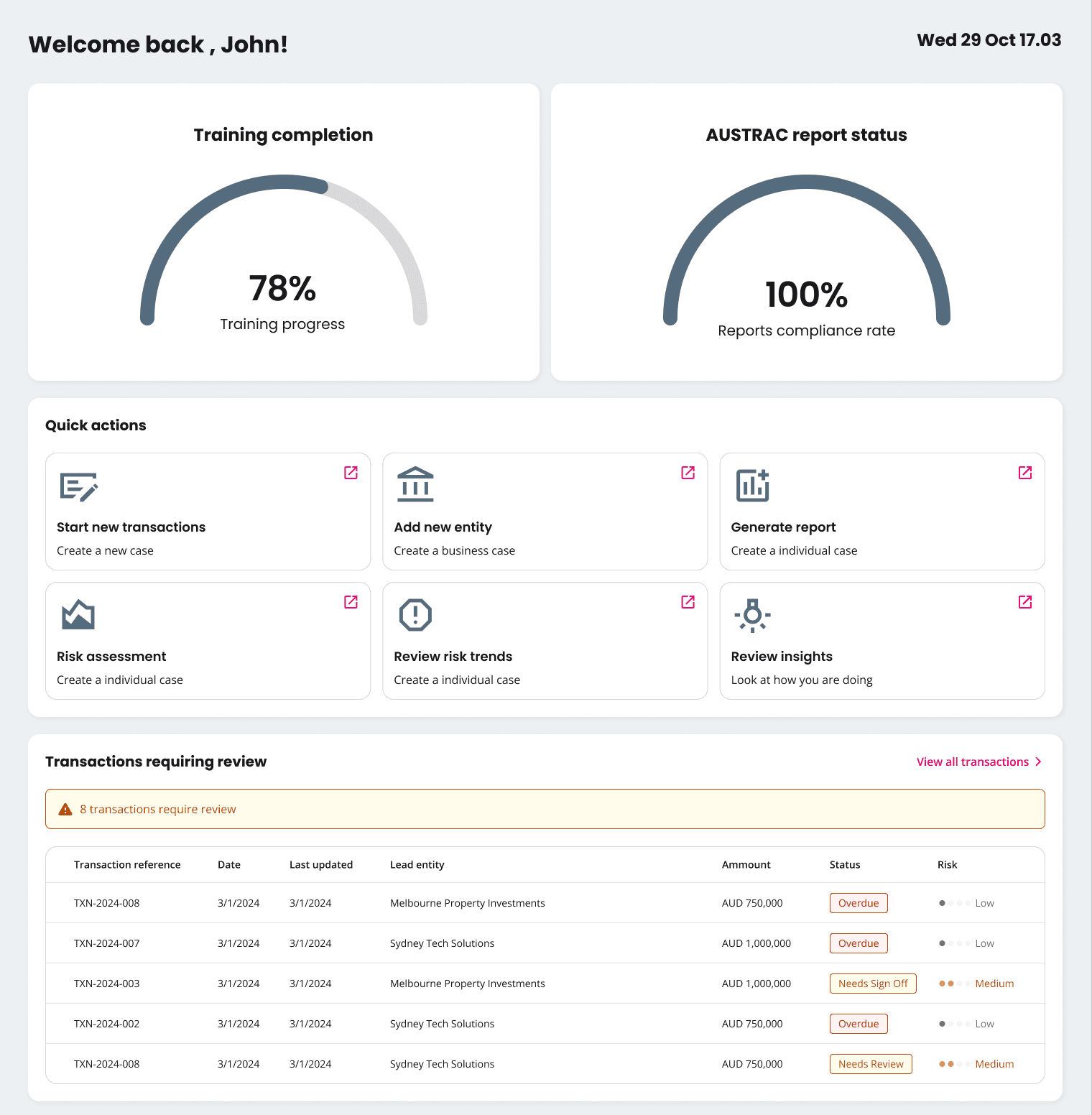

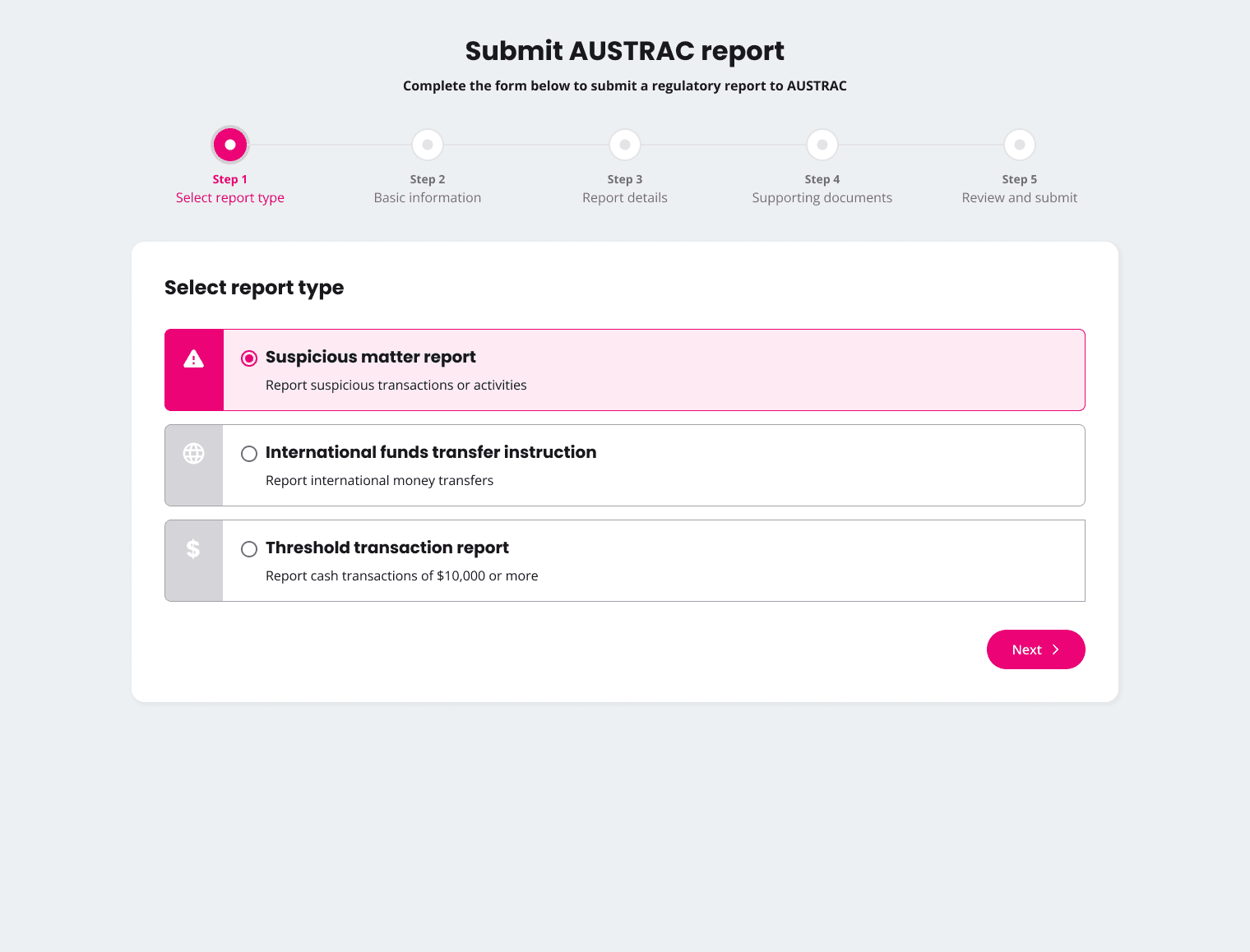

4. Audit-ready reporting submitted directly to AUSTRAC

easyAML keeps you informed of your reporting requirements and prompts you when you need to report. Generate prepopulated AUSTRAC reports in one click, and follow easyAML's guidance to ensure your report is complete and compliant before submission.

- Suspicious activity alerts

- One click AUSTRAC-ready reports

- Records are securely stored and audit-ready for 7+ years

- Timely reporting reminders and notifications.

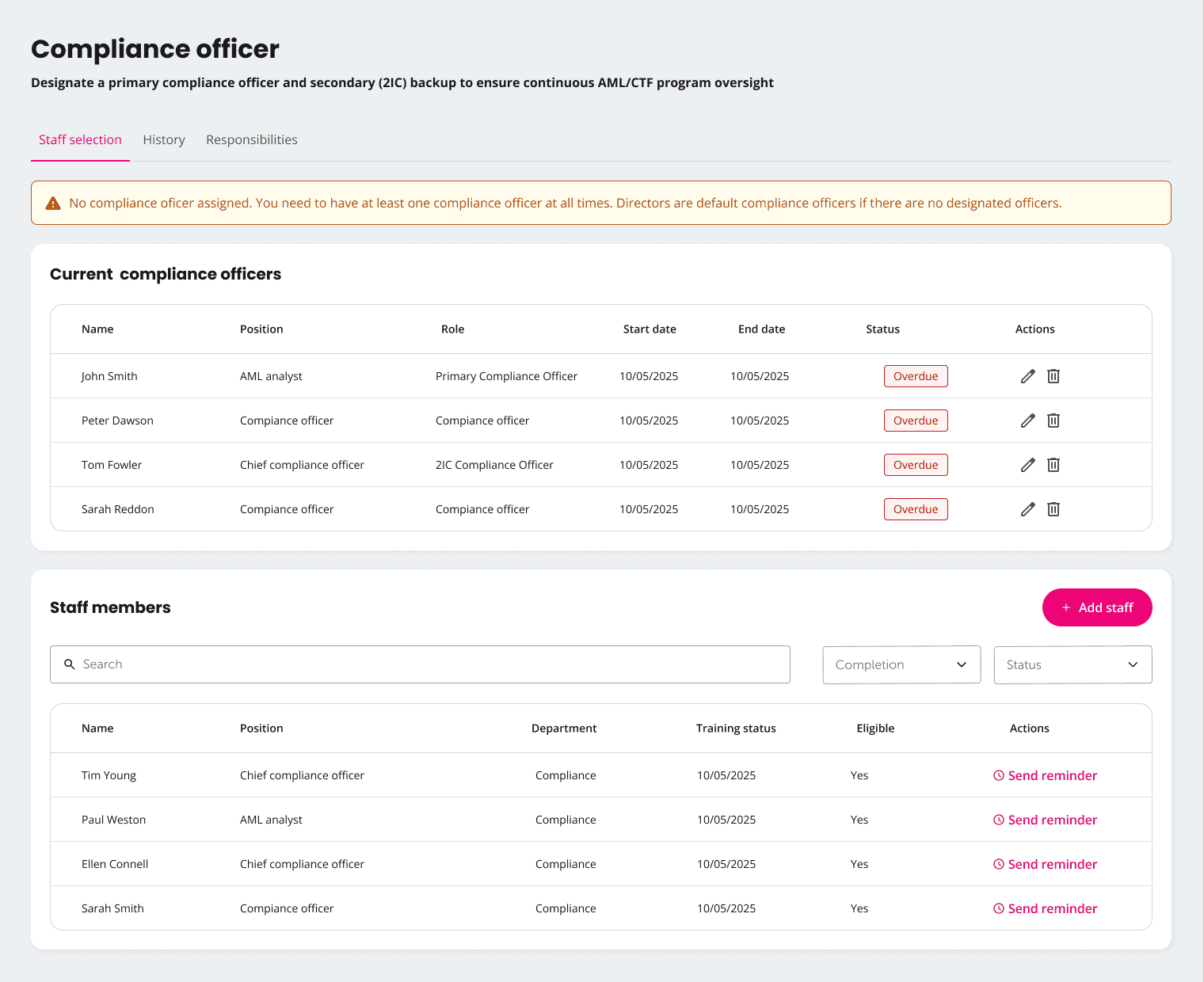

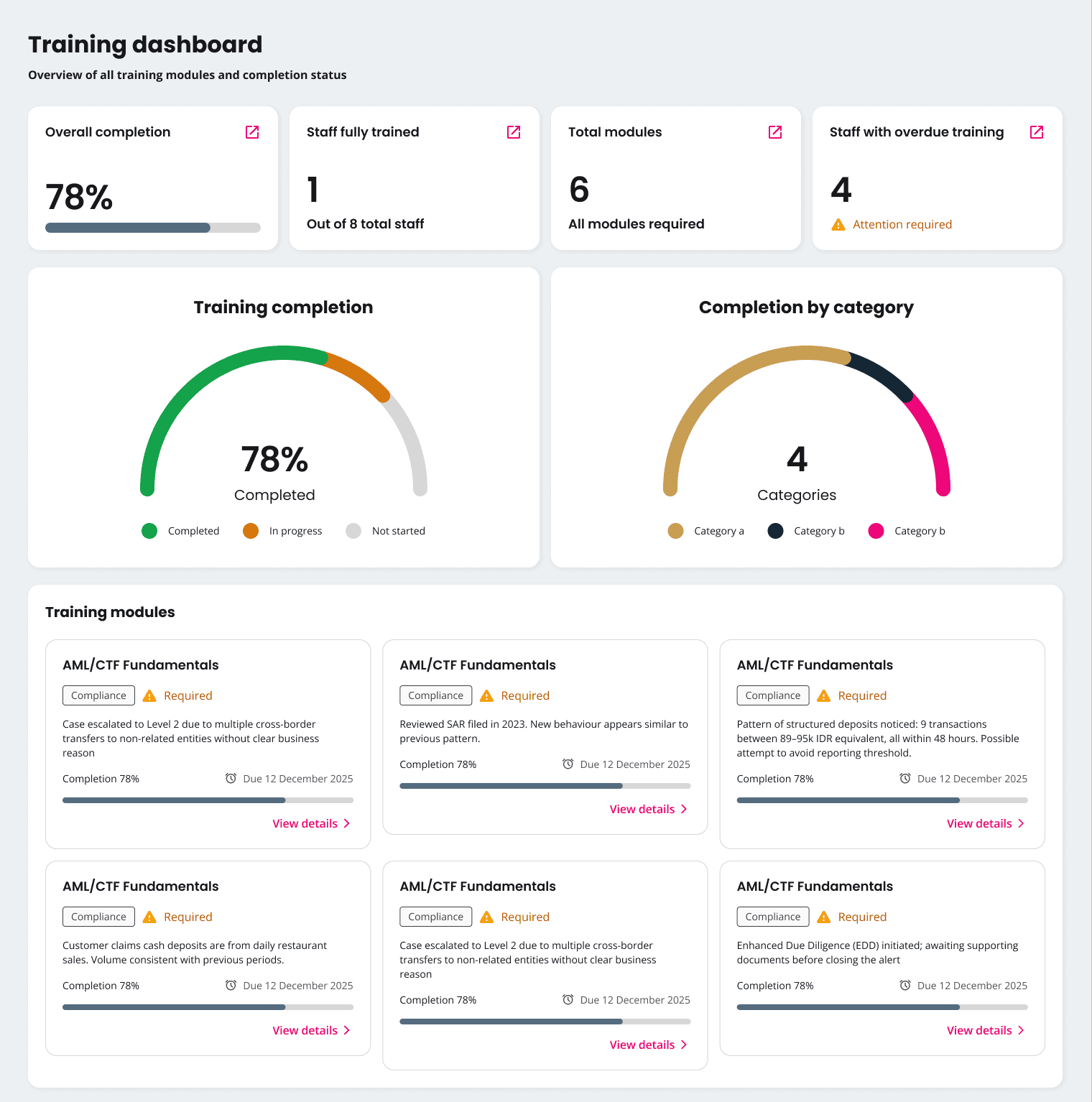

5. Real training for your team

Industry-specific and role-specific AML/CTF training modules are provided by easyAML. Train your team based on the ML/TF risks specific to your business through a mix of interactive learning, micro quizzes, and module tests.

- On-demand compliance training modules

- Comprehensive training dashboard

- Completion records for AUSTRAC compliance

- Future updates to training modules

- Restrictions prevent untrained staff from unauthorised platform areas

6. Dedicated integrations to streamline your workflows

easyAML integrates with the tools and services you are already using to automate and streamline your workflows, minimise data entry and help you stay Tranche 2 compliant.

- Automated data entry, saving time and reducing errors

- Timely prompts to review, assess and report

- Many more integrations coming...

Save time with 3rd party integrations

Integrations into 3rd party CRM systems will be available to provide automated data entry for transactions and other datapoints.

Faster verifications with pre-verified user data

With our large network of verification agencies you may be able to purchase users pre-verified data for instant verfication and avoiding the hassle for your client.

Local Aussie Support Team

Tranche 2 compliance is complicated, our dedicated Australian support team are here to help you every step of the way on your compliance Journey.

Getting started with easyAML

easyAML makes implementing your AML/CTF program fast and easy, with step-by-step guidance. But remember Tranche 2 is just around the corner, the time to start is now.

1.

Choose your plan

easyAML comes in 3 plans, to suit businesses operating at different scales and volume. All 3 tiers provide the tools required for complete Tranche 2 compliance.

2.

Enrol with AUSTRAC

Enrolment with AUSTRAC is a simple process, but it takes time to be finalised. Get started early to meet the deadline. While we can't do this for you easyAML will guide you through the process, and if you need assistance our team is always here to help.

3.

Setup your program

Using easyAML's guided program builder you can generate your industry-specific, risk-specific AML/CTF program with no compliance experience.

4.

Train your team

easyAML provides complete training resources for your whole team, start early so your team has time to learn and practice before compliance is compulsory.

5.

Verify your clients

When the new rules take effect, you must verify your customers before providing any designated services. Onboarding early will ensure a seamless experience for you and your clients.

6.

Sit back and relax, we have it from here.

With your clients onboard, your team up to speed and your program implemented it's back to business. With easyAML Tranche 2 compliance is as simple as recording transactions, verifying your clients, and reporting to AUSTRAC. From here we'll handle the complex stuff, with ongoing monitoring, prompts to report, notifications for key deadlines, and support from our local Aussie support team.

Pricing that makes sense

- Access to everything you need for complete Tranche 2 compliance.

Starter

Cost effective, complete compliance for small businesses with a small team and fewer clients.

- Pay as you go KYC/KYB checks

$179/month +GST

+ KYC & KYB Checks

Professional

Complete compliance to suit most small and medium businesses with a modest team and more clients.

- 10 FREE KYC and 2 FREE KYB monthly checks

- KYC/KYB credit roll over

$449/month +GST

+ Additional KYC & KYB Checks

Enterprise

For businesses looking for a complete white label solution with a big team and many more clients.

- 20 FREE KYC and 4 FREE KYB monthly checks

- White labelling

$999/month +GST

+ Additional KYC & KYB Checks

Why choose easyAML?

How does our AML software stack up?

Choosing the right AML software in Australia means finding a platform that balances affordability, compliance and ease of use. We’ve created a comparison guide to help you assess features like ID verification, reporting tools, risk scoring and AUSTRAC alignment:

easyAML FAQs

-

Do I really need to start preparing for AML compliance now?

Yes. Proper compliance setup takes 3-6 months, and that's after you understand your requirements. Starting early means less stress, better implementation and time to test your systems before go-live come 1 July 2026. Be ready for Tranche 2 reforms by allocating the time your business needs to adapt smoothly and with full confidence.

-

What if the regulations change?

easyAML is constantly monitoring all AUSTRAC updates and will automatically update your compliance program. If the requirements change, we will update your compliance program automatically. You’ll always be aligned with current regulations, with tools and templates that evolve alongside any updates. It’s part of the ongoing support we provide.

-

Can’t I just DIY my AML compliance and save myself the added expense?

Yes, you could. But most DIY efforts take far longer, carry higher risks and leave critical gaps. Based on internal testing, our AML software has shown time savings of up to 80% when compared to manual compliance processes, while maintaining accuracy, consistency and audit-readiness. We’ve built it to minimise the cost for small and medium businesses, without sacrificing quality, completeness or peace of mind.

-

What if my business is not ready by July 2026?

Non-compliance can result in significant penalties for businesses. You'll be ready (without the stress and last-minute rush) if you start with easyAML by January 2026. We’ll walk you through every step, so you’re ready, compliant and confident ahead of go-live.

-

Is AML software necessary for small businesses like mine?

Yes. Especially with Tranche 2 reforms expanding AML obligations to smaller professional services. AML software takes the guesswork out of compliance by helping Australian small to medium business owners verify customers, monitor activity, store records securely and stay audit-ready. If you're in real estate, law, accounting or other designated sectors, talk with us to see if you’ll be affected by these changes.

-

What if I have no prior compliance experience?

You don’t need to be an expert – that’s our job. easyAML’s software is built for people who are great at what they do, not AML compliance. Whether you're in real estate or accounting, we guide you through every requirement with step-by-step tools, straightforward instructions and full support. We make sure nothing is missed and everything is handled correctly.

-

How do I find the best AML software solution for small service providers in Australia?

Look for anti-money laundering software solutions that are simple, affordable and tailored for small-medium teams. easyAML includes ready-to-use programs, refined workflows, verification tools and ongoing monitoring — all aligned to AUSTRAC’s requirements. We understand how real businesses operate. That’s why our support is clear, practical and built to help you meet compliance without confusion.