AML/CTF for small teams: How to build compliance Into roles without burning your team out

An Overview of the Anti-Money Laundering (AML) & Counter-Terrorism Financing (CTF) Act 2006

The hidden admin of Tranche 2: What your business should expect (and how to make it easier)

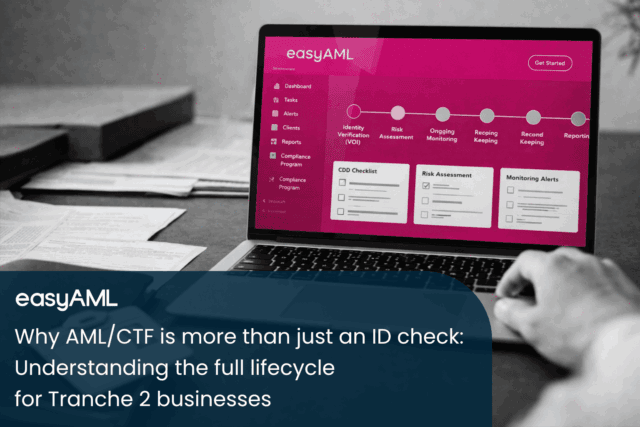

Why AML/CTF is more than just an ID check: Understanding the full life cycle for Tranche 2 businesses

Outsourcing AML/CTF under Tranche 2: What it is, what it isn’t, and how easyAML can help

Here’s what you missed in Tranche 2 compliance updates (and what to do if you haven’t started yet)

We’re almost through November. Decorations are popping up, inboxes are overflowing, and that final sprint to the...

What you need to know about AUSTRAC’s Core Guidance

New AML/CTF Tranche 2 regulations come into effect in 2026, and AUSTRAC recently issued its core guidance, known as its...

Can I share my AML resources across multiple businesses? Let’s look at how Reporting Groups work

How the easyAML Platform Automates Tranche 2 Compliance

With Tranche 2 AML/CTF reforms taking effect from 2026, thousands of Australian businesses — lawyers, accountants,...